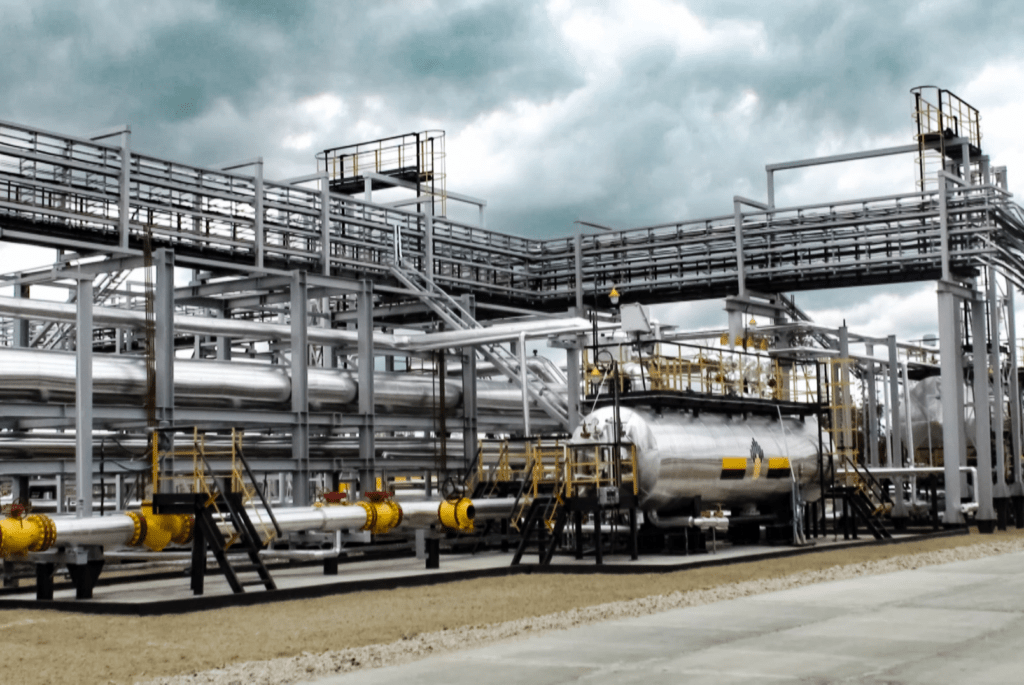

Calash is pleased to announce that it has provided commercial due diligence to infrastructure and private equity investment manager Foresight Group on its investment into Quanta EPC Holdings Limited, a specialist provider of engineering and consultancy services to the energy sector, focused on improving UK energy security and supporting the energy transition from fossil fuels to renewable energy.

Based in the North East of England, Quanta was formed through a buyout from Engie Group in 2018, CEO Nick Oates has broadened the company’s services into renewables and other infrastructure.

Quanta’s experience and skillsets are applicable in the growing markets of hydrogen, carbon capture and offshore wind and Foresight’s investment will help accelerate the company’s presence in these markets. Foresight’s commitment to the company comprises a multi-million pound investment from the Foresight North East Fund, which was launched with ‘cornerstone’ funding from Durham County Council’s Pension Fund and additional funding from Teesside Pension Fund. The investment will enable Quanta to grow its staff base in the Northeast, creating high quality jobs in the region, as well as expand operations.

Calash provided commercial due diligence on the deal on behalf of Foresight, including a review of the target’s business activities, service demand from existing and adjacent markets, and a competitive benchmarking exercise.

The Calash team included Iain Gallow, Callum Evett, and James Kirby.

“The Calash due diligence was of immense help in executing this exciting investment. The Quanta story is tied to the energy transition, and Calash’s energy sector expertise was critical to assessing its commercial proposition and growth potential.”

Daniel Halliday, Director, Foresight Group

Read the full press story Here

Quanta is a specialist provider of engineering and consultancy services to the energy sector, focused on improving UK energy security and supporting the energy transition from fossil fuels to renewable energy.

Foresight Group was founded in 1984 and is a leading listed infrastructure and private equity investment manager. With a long-established focus on ESG and sustainability-led strategies, it aims to provide attractive returns to its institutional and private investors from hard-to-access private markets. Foresight manages over 330 infrastructure assets with a focus on solar and onshore wind assets, bioenergy and waste, as well as renewable energy enabling projects, energy efficiency management solutions, social and core infrastructure projects and sustainable forestry assets. Its private equity team manages ten regionally focused investment funds across the UK and an SME impact fund supporting Irish SMEs. This team reviews over 2,500 business plans each year and currently supports more than 200 investments in SMEs. Foresight Capital Management manages four strategies across six investment vehicles with an AUM of over £1.6 billion.