Calash is pleased to announce that it provided vendor commercial due diligence to Acteon Group, an offshore energy infrastructure services business, in support of its sale to Buckthorn Partners and One Equity Partners (OEP).

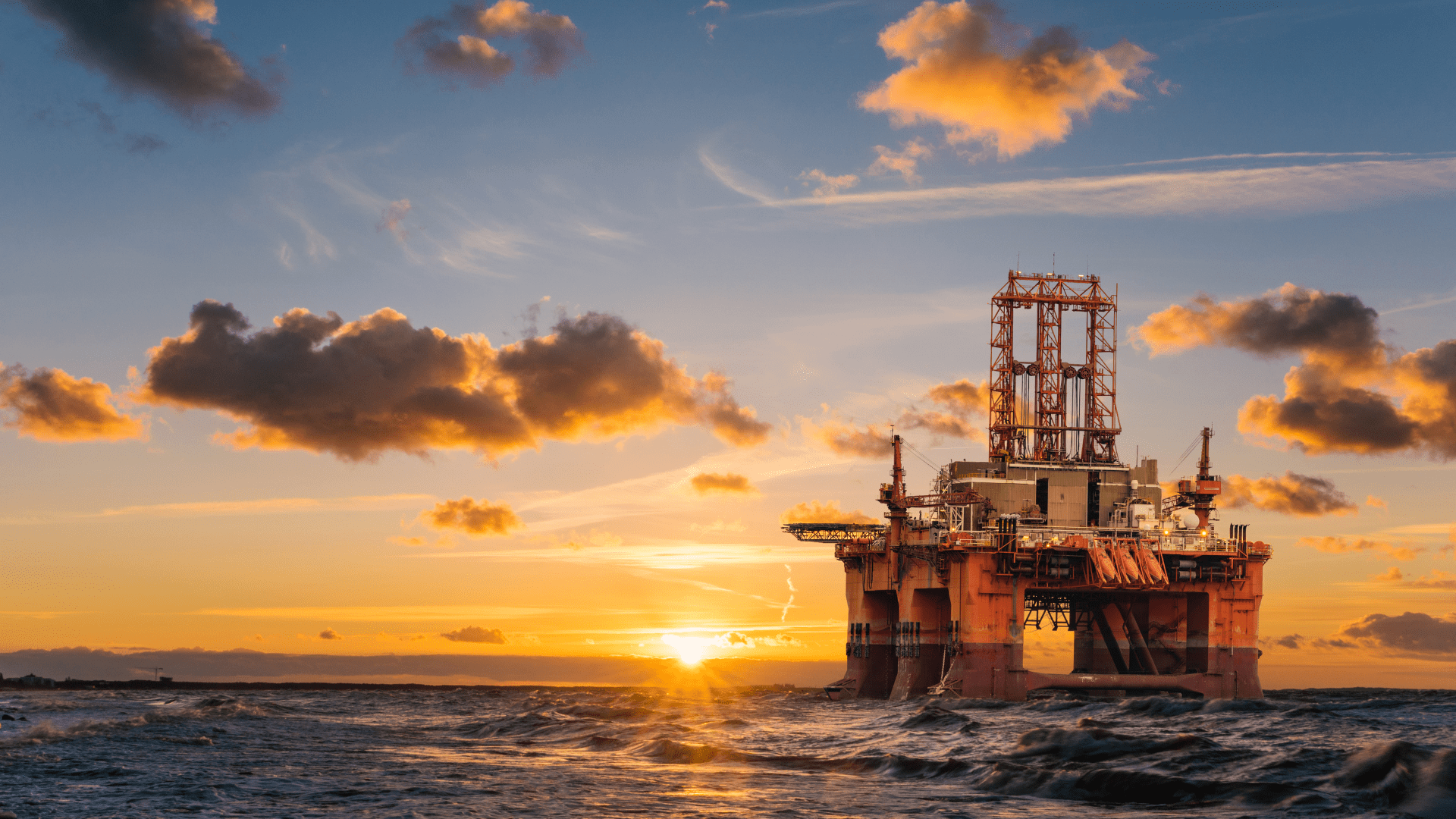

The Aberdeen-headquartered company provides specialist engineering, services and technology to companies that develop and own offshore energy infrastructure across all phases of the lifecycle.

Calash provided vendor commercial due diligence on behalf of Acteon and its other advisors, which included a review of its business activities, underlying commercial drivers across the oil and gas and renewables sectors, a review of its addressable market, a competitive analysis exercise, a review of its business plan, and extensive customer and market referencing.

The acquisition by Buckthorn and OEP will facilitate the exit of KKR, which has been invested in the business since 2012, and will include significant investment into Acteon to improve its market positioning in its core markets. The new investors will focus the business on its survey, foundations, moorings, decommissioning and consulting engineering services that support the offshore renewable, and offshore oil and gas market sectors.

The Calash team included Rob Neves and Mario Petrov.

“Acteon’s products and services are key to the energy transition in constructing, maintaining and supporting offshore energy infrastructure. We are very pleased to acquire Acteon and its market-leading capability in managing offshore renewable, and offshore oil and gas infrastructure. Our ownership will bring stability to the business, and investment and expertise to grow and develop the company.”

Rob Willings, Partner, Buckthorn Partners

Read the full press release here

Acteon Group was established in 1989 and employs 2,300 staff operating from 58 locations across 14 countries worldwide. It supports marine projects for the offshore renewable energy, nearshore construction and oil and gas industries by delivering services with demonstrable commercial and environmental benefits which are enabling the energy transition.

Buckthorn Partners invests in industrial businesses providing products and services that support the growth and integration of renewable energy, lower emissions, energy efficiency and improvements to existing energy infrastructure.

One Equity Partners is a middle market private equity firm with approximately $10 billion in assets under management focused on transformative combinations within the industrial, healthcare and technology sectors in North America and Europe.