Calash is pleased to announce that it provided vendor commercial due diligence to EV Holdings (EV), a leading global provider of vision-based diagnostics and analytics services for the oil and gas sector, in support of its sale to Enersol, a joint venture between ADNOC Drilling and Alpha Dhabi Holding.

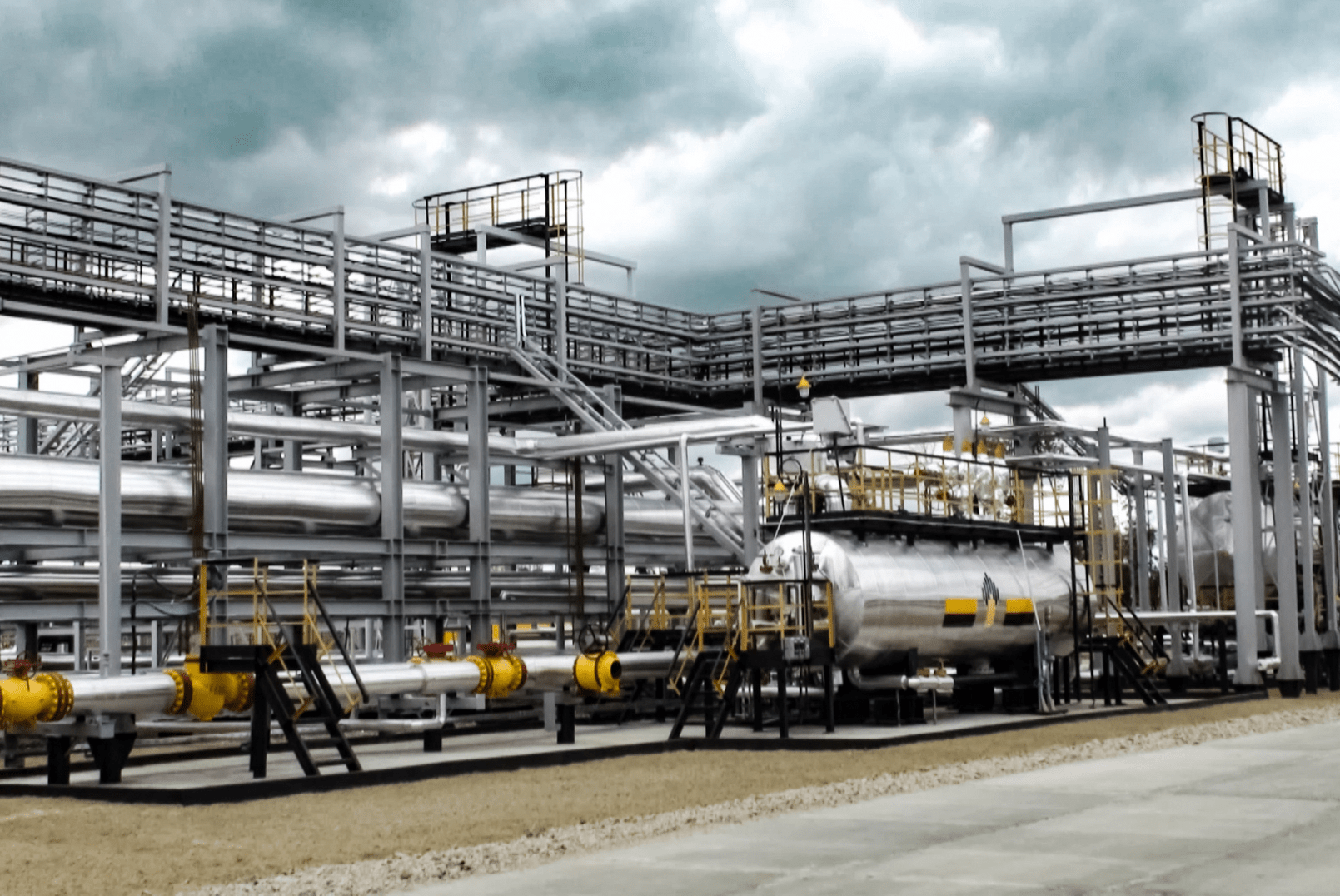

EV, which has its corporate headquarters in the United States, offers well diagnostics services by leveraging a range of solutions that resolve highly complex wellbore issues across the well lifecycle, with a presence in 36 countries, including the UAE and Saudi Arabia.

Calash worked closely with the EV management team to provide vendor commercial due diligence, which included a review of its business activities, validation of its technology, a review of its addressable market, a competitive analysis exercise, a review of its business plan, and extensive customer and market referencing.

Enersol is acquiring the business for approximately $45 million. It had previously been in invested in by UK-private equity firm Dunedin, which first deployed capital into the business in 2014.

The Calash team included George Maitland, Callum Evett, and Mario Petrov.

“EV’s technology is highly specialised, so Calash’s focused understanding of the energy market and its highly experienced technical team was important in demonstrating the high value of our business. The team was swift, responsive and detailed and became a key part of our efforts during divestment, providing close support from the outset right through our diligence process.”

Fraser Louden, CEO, EV Holdings.

Read the full press release here

EV was founded in the UK in 1999 by Jonathan Thursby, its Chief Technical Officer, in between international adventures with the team from Top Gear. Combining an early love of video technology with a passion for fast cars, Jonathan worked across a range of television and sporting events, honing his knowledge of video equipment in extreme environments to create a product that is now used in 70% of all offshore operations. EV’s specialized well diagnostic solutions are offered through market-leading 360 degree downhole cameras, integrated camera-ultrasound technology and other tools that generate vivid and visual diagnostic information to enable the rapid and effective evaluation of technically challenging well issues. EV has also developed AIVA, a tool agnostic cloud-based data storage, visualization platform including through the application of AI and machine learning techniques to accelerate data transfer, storage and analysis. By leveraging the EV Technology Centre dedicated to research and development in the UK, EV is home to 116 patents and has a successful track record of bringing new and innovative products to market. Over the next two years, EV is targeting the introduction of a strong pipeline of products on account of its R&D capabilities, including pipeline visualization and software analytics.

Enersol is actively advancing plans to acquire and invest in multiple businesses and foster a scalable ecosystem that will enhance market value and position the JV as a technology-centric investment platform to the energy sector. This is Enersol’s third acquisition, having last week signed an agreement to acquire 51% of NTS Amega (NTS), a leading global manufacturer of advanced precision equipment and solutions provider for the energy sector, subject to customary and regulatory approvals. Enersol also has agreed to acquire an additional stake (to a total 67.2% majority) in Gordon Technologies, a US-based provider of measurement while drilling services.